Escape on Wheels: The Rise of RV Travel Amid Housing Costs and Remote Work

In the following case study, we explore one of the most significant lifestyle shifts of the past decade: the rise of RV living as both an economic strategy and a reimagining of the American Dream.

Housing Costs Slammed it Shut

- The pandemic accelerated a cultural shift, transforming RV ownership from a niche hobby into a mainstream lifestyle. Over 8.1 million U.S. households now own an RV, representing a significant expansion of the market.

- The boom in RV living was driven by a convergence of three key factors: the rise of remote work, soaring housing costs, and the desire for a “safer” travel option during the pandemic.

- Remote work untethered millions from the office, making RV living a viable option for digital nomads. Approximately 22% of RV-owning households include at least one remote worker, and for those aged 25–34, this figure is as high as 70%.

- With median home prices soaring, many, particularly younger generations, are choosing RVs as an alternative to traditional homeownership.

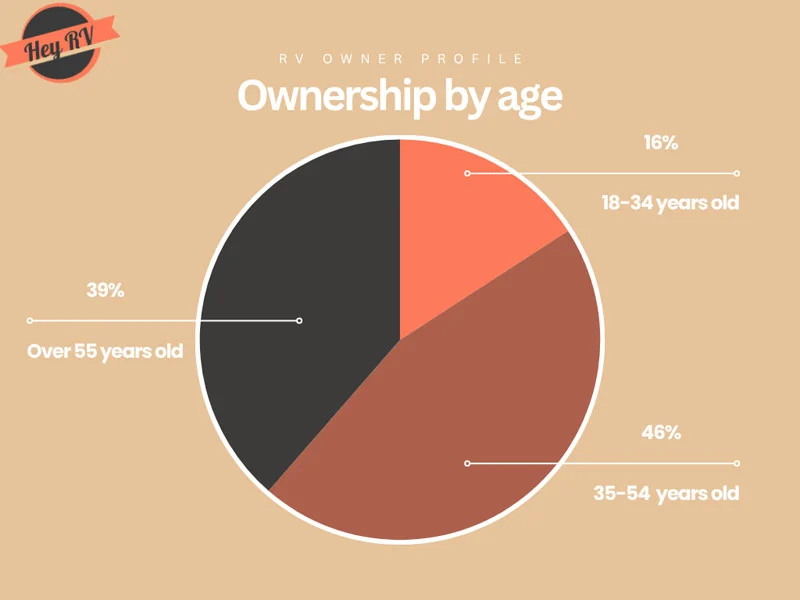

- The modern RV owner is not just a retiree. The RV community has evolved into a multi-generational movement with a diverse demographic. While owners aged 35–54 make up the largest group, at 46%, younger demographics, specifically those aged 18–34, are the fastest-growing segment, accounting for 16% of owners.

- The financial journey of an RV is marked by rapid depreciation. A new motorhome can lose approximately 20% of its value in the first year alone, with a total loss of over 60% after just five years. This makes major repairs on an older vehicle a financially unfeasible decision for most owners.

- The unprecedented number of RVs sold during the pandemic boom means a corresponding wave of vehicles will soon be reaching the end of their useful life. These are often too expensive to repair, too time-consuming to sell privately, or too old to be accepted at many campgrounds.

- As RVs depreciate and become a financial liability, a new market for their disposal has emerged. Cash-for-junk-RV services are on the rise, offering a streamlined and professional solution for owners to monetize their unusable vehicles and unlock household liquidity that would otherwise be left idle.

- The rise in RV ownership has created a robust industry not just for new vehicles, but also for services that manage their entire lifecycle. The U.S. RV market is projected to reach $36 billion in 2025, with manufacturers, campgrounds, and digital platforms all experiencing significant growth.

A New American Dream on the Road

When the pandemic hit in 2020, the meaning of “home” shifted almost overnight. Apartment balconies became gyms, kitchens doubled as offices, and living rooms turned into classrooms. Suddenly, where you lived mattered less than how you lived, and for millions of Americans, the call of the open road was too strong to ignore.

Instead of moving to bigger houses in the suburbs, many traded fixed addresses for rolling ones. The RV, once a symbol of retirement road trips, has transformed into a mobile office, a family home, and, for some, a ticket to financial freedom. Today, more than 8.1 million American households own an RV, reflecting the deep penetration of this lifestyle into the mainstream.

What began as a niche hobby has become a cultural movement. Driven by soaring housing costs, the rise of remote work, and a hunger for adventure, RV living is no longer just about vacations; it is increasingly seen as a viable alternative to traditional housing.

The Perfect Storm: Why RV Living Boomed

A cultural shift was already underway, and the pandemic simply accelerated it. Remote work untethered millions from the office, housing costs priced many out of traditional homeownership, and a desire for safer travel redefined the idea of escape. This convergence of factors, which we can call the ‘Perfect Storm’, made the RV, once a vacation vehicle, suddenly a viable answer to all three.

Remote Work Opened the Door

The shift to remote work removed one of the most prominent anchors keeping people in place: the office. Following the 2020 pandemic, tech giants such as Meta, Spotify, and Twitter adopted “work from anywhere” policies. For a growing number of workers, “anywhere” meant waking up to a mountain sunrise in Colorado or answering emails beside a Pacific beach. RV life became a natural fit for digital nomads: a private, mobile workspace with a view.

According to a study from Progressive, 22% of RV-owning households now include at least one remote worker. This indicates that nearly one in four RV households blends mobility with professional life, demonstrating how remote work has become a central driver of RV adoption.

The impact is even more pronounced among younger owners. For RVers aged 25–34, 70% report the ability to work remotely, highlighting how this age group is reimagining both their careers and lifestyles by choosing mobility over fixed housing.

Of the 22% of RV-owning households that include at least one remote worker, just over half (54%) actively work while traveling. In other words, about one in eight RV households overall are not only equipped for remote work but are actually blending their professional responsibilities with life on the road.

Housing Costs Slammed it Shut

At the same time, home prices in the U.S. skyrocketed. An analysis from the National Association of Realtors revealed that the median home price in 2023 hovered around $400,000, up nearly 40% from just five years prior. In cities like San Francisco or Austin, rents soared beyond affordability. For many, especially millennials and Gen Z workers, buying a home became an impossible dream. An RV, on the other hand, offered ownership without the mortgage.

For many younger professionals, the math was simple:

- Buy a house → decades of debt, limited mobility.

- Buy an RV → full ownership, flexible lifestyle, lower ongoing costs.

The decision to buy an RV wasn’t just about saving money; it was about reclaiming control over where and how to live, and embracing a lifestyle that offers unparalleled freedom and flexibility.

A Pandemic-Proof Escape

Amid lockdowns and closed borders, RVs became the ultimate tool for social distancing with adventure.

- Travel without hotels → No shared lobbies, elevators, or hallways.

- Movement without airplanes → Avoid crowded airports and flight cancellations.

- Adventure without risk → Explore nature while staying self-contained.

Even as borders reopened, the RV lifestyle stuck for many; it became less of a temporary fix and more of a permanent choice, offering a sense of safety and security in uncertain times.

Who’s Hitting the Road?

The modern RVer bears little resemblance to the stereotype. Research on the RV lifestyle shows that the once-retiree-dominated pastime has evolved into a diverse, multi-generational movement. From millennials chasing remote work freedom to families turning the country into a classroom, the road has become a shared address for people at every stage of life, making everyone feel included in this diverse and welcoming community.

The age distribution of RV ownership demonstrates that the lifestyle appeals to a wide demographic, but is mainly concentrated among midlife and older adults. Based on data from the RV Industry Association:

- 16% of RV owners are between 18–34 years old. While this group represents the smallest share, younger adults are increasingly entering the market, often driven by the flexibility of remote work and a desire for affordable, mobile housing alternatives.

- 46% of RV owners fall between 35–54 years old. This segment represents the largest share of owners. Many in this group use RVs for family travel, seasonal living, or as an extension of hybrid work arrangements. Their adoption reflects both financial capacity and lifestyle flexibility.

- 39% of RV owners are over 55 years old. Historically the backbone of the RV market, retirees continue to play a central role. For many, RVs offer a cost-effective way to downsize while maintaining the freedom of mobility during their retirement years.

This distribution illustrates that while RV ownership remains strongest among older adults, younger demographics are steadily reshaping the market. The growth of the 18–34 age group signals a cultural shift: RVs are no longer viewed solely as retirement vehicles, but as versatile housing and travel options for multiple life stages

Millennials and Gen Z: Freedom Seekers

Ironically, the generations once accused of “killing” the RV industry have become its fastest-growing customer base. For millennials and Gen Z, the appeal isn’t in chrome bumpers and kitschy awnings, but in the freedom they represent. These are generations shaped by housing instability, student debt, and the rise of the gig economy. They’ve redefined success not by the size of a mortgage, but by the number of stamps in a passport or pins on a digital travel map.

Today, RV ownership among younger adults has grown steadily, reflecting a shift in how mobility and lifestyle are prioritized. Many in this group are blending work with travel, using remote connectivity to transform campgrounds and scenic locations into functional offices. For them, sunsets, minimal living, and a constantly changing view have begun to replace the traditional notion of the white picket fence as a marker of success.

Families and Empty Nesters: Downsizing with Purpose

Two very different life stages, one shared solution: the road. For empty nesters, the kids are grown, the big house feels empty, and the maintenance list keeps getting longer. Many are trading in the lawnmower for a set of keys to a fifth wheel, opting for experiences over possessions. Families, on the other hand, are embracing the open road for an entirely different reason: education. “Roadschooling,” the practice of homeschooling while traveling, has exploded in popularity. National parks become science labs, historic landmarks double as history lessons, and every stop becomes part of the curriculum.

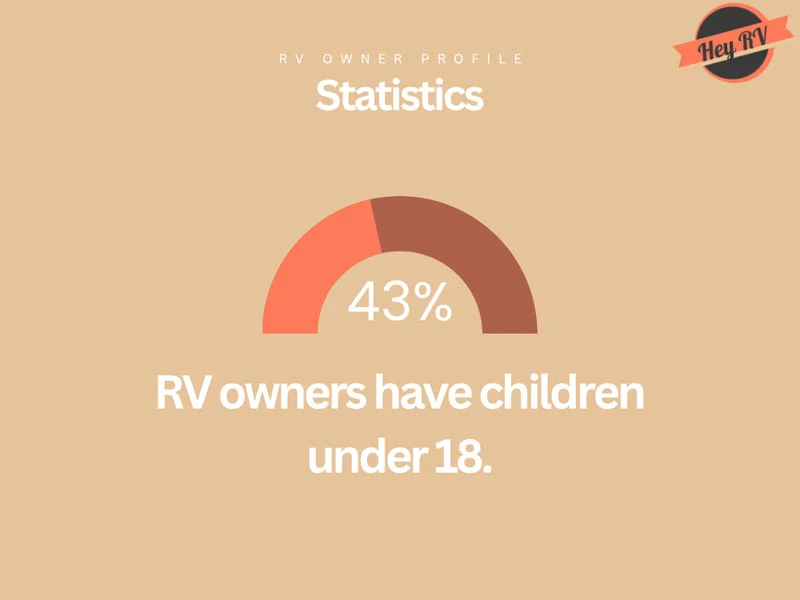

In fact, 43% of RV owners have children under 18, proof that the RV lifestyle isn’t just for retirees or solo travelers; it’s increasingly a family affair.

Digital Nomads and Creators

The rise of the influencer economy has given rise to a new class of road warriors. Content creators, YouTubers, and travel bloggers are outfitting their rigs with Wi-Fi boosters, solar panels, and camera gear, transforming their travels into monetized content streams.

For these RVers, every campsite is a potential studio and every trip a content series. Brand partnerships, affiliate marketing, and Patreon subscriptions turn gas money into a business expense.

A More Diverse Driver’s Seat

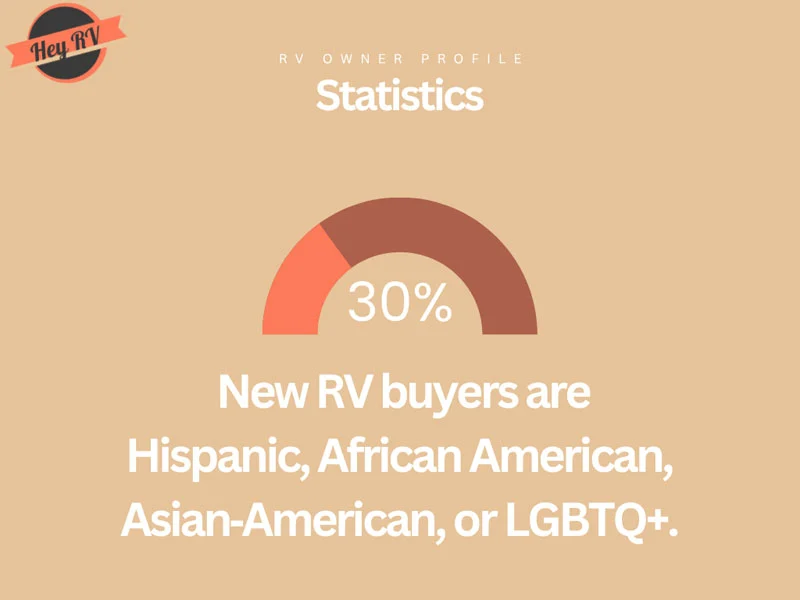

The RV community is becoming more representative of the broader U.S. population. 30% of new RV buyers are Hispanic, African American, Asian American, or LGBTQ+, a sign of how rapidly the demographics are shifting. Industry outreach and evolving cultural perceptions have helped open the RV lifestyle to communities that were historically underrepresented in the space. This change signals a broader truth: RV living is no longer a niche pastime; it’s a cross-generational, multicultural movement redefining how Americans live, work, and travel.

Fill in the Contact Form to Sell Your Junk RV today!

Life Inside an RV vs. Traditional Housing/Renting

Rising housing costs in the United States have intensified interest in alternatives to traditional renting and homeownership. Mortgage payments, property taxes, and escalating rents place significant financial pressure on many households, prompting exploration of unconventional but practical solutions.

One such alternative is full-time RV living. No longer limited to recreational use, modern RVs now incorporate amenities and design features that rival those of conventional housing, while also providing the added advantage of mobility. For individuals and families facing affordability challenges or seeking greater flexibility, RV living represents a viable option.

The following section compares key aspects of traditional housing and RV living, including comforts, cost structures, utilities, connectivity, and lifestyle flexibility, drawing on data from industry sources such as Nomads in Nature. This analysis highlights how RV living can, in some circumstances, present an adaptable housing model.

Comforts Compared

- Traditional housing: Conventional homes and apartments offer fixed utilities, permanent structures, and standardized layouts. Comfort is determined by location, available infrastructure, and neighborhood amenities.

- RVs: Contemporary recreational vehicles provide a range of residential features once exclusive to permanent housing. Depending on the model, these include full kitchens, residential bathrooms, washer-dryer units, climate control, solar integration, and smart-home technology. Higher-end models are comparable in comfort to urban condominiums, while even entry-level units provide functional and adaptable living arrangements.

Cost of Living

- Traditional housing: The median rent for a one-bedroom apartment in the United States is approximately $1,500 per month, with rents in metropolitan areas often exceeding $2,000 to $4,000 per month. For homeowners, the median monthly mortgage payment rose to $2,250 to $2,500 in 2025. When taxes, insurance, and maintenance are factored in, the average monthly ownership cost reaches an estimated $3,000.

- RVs: Full-time RV living typically costs between $1,500 and $3,000 per month, covering expenses such as campground fees, insurance, fuel, and internet. Budget-conscious travelers who boondock may spend closer to $1,000–$1,500, while those choosing premium resorts can exceed $3,000. Rather than eliminating costs, RV living reallocates them, transforming housing payments into flexible, mobility-driven spending. The value lies not in guaranteed savings but in geographic freedom, adaptability to work opportunities, and the experiential benefits of life on the road.

Upfront Costs

- Traditional housing: Renters are responsible for security deposits, while homebuyers face down payments averaging $30,000 to $60,000, in addition to closing costs. Long-term ownership also entails insurance, annual property taxes, and ongoing structural maintenance.

- RVs: Recreational vehicles vary widely in price, from approximately $20,000 for entry-level travel trailers to over $300,000 for luxury Class A motorhomes. Financing can begin as low as $120 per month, but additional annual expenses include insurance ($600-$1,200) and maintenance (typically 1–3% of the vehicle’s value).

Utilities and Internet

- Traditional housing: Monthly utility costs, including electricity, water, gas, and internet, average $400–$600 per month. These represent fixed expenses regardless of changes in occupancy or usage.

- RVs: Many campgrounds include water, sewer, and electricity within site fees. For off-grid living, solar systems ranging from $200 to over $10,000 provide supplemental power. Connectivity relies on mobile infrastructure, with services like Starlink ($50-$165/month) and cellular hotspots ensuring consistent service.

Connectivity and Work

- Traditional housing: Broadband access in permanent housing is generally reliable, supporting stable home office arrangements. Remote work is typically based in one location.

- RVs: Advances in satellite and cellular internet now enable remote work from mobile environments. Many full-time RV residents set up mobile offices equipped with ergonomic equipment, making location-independent employment feasible without compromising productivity.

Lifestyle Flexibility

- Traditional housing: Offers long-term stability and integration within a single community, but it restricts mobility. Relocation involves significant financial and logistical effort.

- RVs: Provide geographic flexibility, allowing residents to relocate frequently and adapt to seasonal or professional needs. RV-based travel is also documented as being 25–50% less costly per day than conventional hotel- and airfare-based vacations, contributing to broader affordability.

Monthly Cost and Living Structure Comparison: Renting, Owning, and RV Living

| Category | Traditional Housing (Rent) | Traditional Housing (Own) | RV Living (Full-Time) |

| Monthly Housing Cost | ~$1,500 | ~$2,250 Mortgage

~$180 Homeowner’s Insurance |

~$1,500–$3,000 (camping, fuel, utilities, etc.) |

| Upfront/Hidden Costs | Security deposit (renters): 1 month’s rent | Down payment (owners): $30k–$60k | RV $20k–$300k purchase; financing from ~$120/month; annual maintenance/repairs amortized |

| Utilities & Internet | ~$400-$600/month (electricity to streaming) | Same | ~$50–$200 utilities; campsite often includes; Starlink ~$50-$165 |

| Campsite / Rent Expense | N/A | N/A | ~$250–$1,500/month (camping); $0 if boondocking |

| Mobility | Fixed, limited mobility | Fixed, limited mobility | Full mobility, relocate anytime |

| Comfort & Lifestyle Amenities | Standard housing | Standard housing | Full kitchens, smart features, slide-outs, scenic views |

| Remote Work Setup | Reliable home internet | Reliable home internet | Starlink/5G mobile office solution |

| Overall Cost Range | ~$2,100/month | ~$3,030/month | ~$1,620–$3,000/month |

While monthly RV expenses often overlap with rent or mortgage costs, the distinction lies in cost structure and lifestyle flexibility. Traditional housing requires residents to make fixed payments and stay in a single location, whereas RV living reallocates those expenses toward mobility and experiences.

For some, RV life can be less expensive through boondocking and careful planning; however, for others, resort-style camping or extensive travel can exceed the costs of traditional housing. Affordability in this context is less about universal savings and more about the freedom to allocate resources into a lifestyle that aligns with mobility, work opportunities, and personal values.

Types of RVs Owned: Market Composition and Consumer Preferences

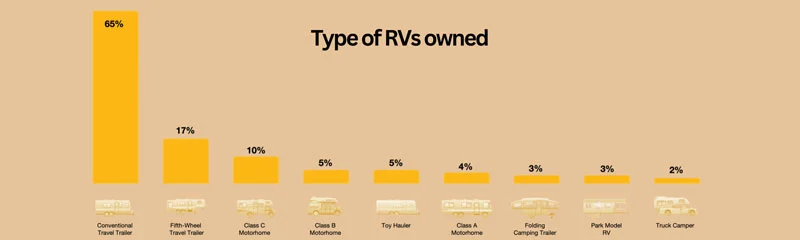

According to the RV Industry Association’s 2025 Owner Demographic Profile, the composition of RV ownership reflects clear patterns of consumer preference within the market.

Conventional travel trailers dominate the RV market, accounting for 65% of RVs on the road. Their popularity is driven by affordability, flexibility, and ease of towing, making them an attractive option for both first-time buyers and experienced travelers.

Fifth-wheel trailers represent the second-largest share at 17%. These larger, towable units appeal to households seeking greater living space and long-term comfort, often favored by seasonal or full-time RVers.

Motorhomes hold a combined but smaller share. Class C motorhomes account for 10%, while Class B models make up 5% of the market. Their self-contained design and drivability make them well-suited for families and individuals who prioritize convenience and mobility. Class A motorhomes, with an appeal of 4%, cater to a niche of buyers seeking luxury features and residential-style amenities.

Smaller categories include toy haulers (5%), valued for their versatility in transporting outdoor equipment, and folding camping trailers (3%), which provide an entry-level option for budget-conscious buyers. Park model RVs (3%) and truck campers (2%) occupy the niche end of the spectrum, serving specialized needs for extended stationary living or compact travel.

Together, this distribution demonstrates the diversity of the RV market. While travel trailers remain the most accessible and widely adopted choice, demand spans across a range of vehicle types, reflecting the varied lifestyles and priorities of RV owners.

The Hidden Challenges of Life on the Road

The romance of the open road comes with a dose of reality. For every photo of a cliffside sunrise, there’s a story about a flat tire in the middle of nowhere or a scramble to find a legal overnight spot. Life in an RV demands flexibility, resilience, and a willingness to tackle problems that don’t come with a landlord or maintenance team. The freedom is absolute, but so are the challenges.

It’s Not Always Glamorous

Behind the glossy Instagram posts and sunset selfies, life on the road can be as demanding as it is liberating. RV breakdowns happen sometimes miles from the nearest mechanic. Maintenance isn’t optional; it’s a weekly reality. And yes, someone has to empty the waste tanks.

Weather can also change quickly from scenic to severe, with heatwaves, cold snaps, and storms testing both comfort and safety.

Legal and Logistical Issues

Modern nomads face more than just mechanical challenges. Overnight parking is harder to come by, as cities like Los Angeles and Seattle tighten restrictions on urban RV dwellers. Insurance, vehicle registration, and mail forwarding all require creative solutions. Residency laws and taxes vary by state, and not all are friendly to full-time RVers.

Mental Health and Community

The freedom of constant travel comes with an often-overlooked cost: isolation. Deep, lasting friendships are more complicated to maintain when your zip code changes weekly. Many RVers turn to digital lifelines, such as communities like the RV Entrepreneur Facebook group, platforms like Campendium, and the #vanlife Instagram network, to find connection and support on the move.

The RV Economy: Big Business on the Move

What began as a short-term response to the pandemic has evolved into a sustained, multi-billion-dollar ecosystem, one that is innovating at an unprecedented pace. From manufacturers to tech startups, campgrounds to peer-to-peer rental platforms, new data confirms that the RV economy is in high gear and shows no signs of slowing down.

Industry Growth and Innovation

The numbers underscore the magnitude of the change. In 2021, U.S. RV shipments reached an unprecedented 600,000 units. While production cooled to 333,700 units in 2024, roughly half the pandemic peak, it still exceeded levels from the early 2010s. The U.S. RV market is projected to reach $36 billion by 2025, with an annual growth rate of approximately 8% through 2030.

Manufacturers are rapidly adapting to consumer expectations, offering lighter, more energy-efficient models with integrated technology. High-tech features such as remote monitoring systems, infotainment dashboards, and off-grid power capabilities are now standard.

Campgrounds, Startups, and Platforms

The surge in RV ownership and use has created opportunities across services and infrastructure. The United States has an estimated 15,000–16,000 RV parks, with average occupancy rates of 60–70%, often peaking near full capacity in summer months. By 2029, U.S. campground revenue is projected to reach $11.4 billion (CAGR 1.4%).

Digital platforms are also reshaping access and usage. Outdoorsy is expected to surpass $3 billion in lifetime bookings by 2024, while RVshare reports that nearly 60% of travelers plan an RV trip within the next year and 47% prefer RVs as their primary lodging. Travel motivations reflect lifestyle diversity: 67% visit national parks, 63% attend festivals, and 53% use RVs for tailgating.

Eco-Friendly Movement

Sustainability has shifted from a niche concern to a market driver. Demand is increasing for solar power, lithium battery systems, and environmentally friendly materials. Meanwhile, many manufacturers are experimenting with recycled components, energy-efficient appliances, and even electric-powered RV prototypes. For buyers, environmental considerations are increasingly as important as interior design or floor plans.

Global Momentum

The RV phenomenon extends beyond the United States. The global RV rental market is valued at $2.72 billion in 2025 and projected to reach $3.62 billion by 2030, reflecting a compound annual growth rate of ~5.9%. This trajectory aligns with broader shifts in consumer behavior, where experiences are prioritized over possessions, and mobility is associated with both freedom and resilience.

The Future of RV Living: Trend or Transformation?

The RV boom began as a response to extraordinary circumstances: a global pandemic, a housing affordability crisis, and a once-in-a-generation shift to remote work. But what started as a necessity for some has evolved into a deliberate choice for many. The question now is whether RV living will remain a cultural fixture or recede as life “returns to normal.”

Permanent Shift or Pandemic Fad?

Skeptics predict that the RV lifestyle will fade if housing prices cool and more employers call workers back to the office. But the data and the sentiment from the road suggest otherwise. Once people have experienced the flexibility of location independence, the prospect of going back to a fixed, stationary lifestyle can feel like a step backward.

Hybrid models are emerging, where professionals live in RVs for part of the year and maintain a home base for the rest. This balance offers both the stability of a fixed address and the freedom of mobility, a model that could define the next phase of the movement.

Vanlife 2.0: Beyond the Aesthetic

The early days of “vanlife” were all about the curated Instagram shot: fairy lights, coffee mugs, and mountain backdrops. But as the movement matures, functionality is overtaking pure aesthetics. Travelers are seeking rigs that are modular, durable, and optimized for full-time living.

Expect to see:

- Electric RVs and vans are entering the mainstream

- Modular, upgradable interiors to extend vehicle life and flexibility

- Community-focused living arrangements, from convoy travel groups to mobile co-housing concepts

This evolution makes the lifestyle more accessible, sustainable, and inclusive.

Cities and Infrastructure Will Adapt

The growing population of RVers isn’t just reshaping individual lifestyles; it’s challenging urban planners and local governments. More towns are recognizing the economic potential of catering to nomads through:

- Designated overnight parking zones

- Mobile co-working hubs with high-speed internet

- Seasonal or event-based RV accommodations

- Updated regulations to balance freedom with neighborhood concerns

Just as the rise of rideshare services has compelled cities to reassess their transportation strategies, the emergence of the modern nomad is likely to impact how municipalities approach housing, tourism, and infrastructure.

Whether it’s a full-time commitment or a seasonal choice, RV living has outgrown its stereotype as a retiree pastime. It’s becoming a legitimate, long-term housing and lifestyle option that blends mobility, affordability, and personal freedom in a way that aligns with 21st-century values.

The Unavoidable Reality: RV Depreciation and End-of-Life Planning

The romanticized vision of the RV life, full of open roads and endless adventure, has a less glamorous financial reality. Like all vehicles, RVs are depreciating assets. This fact introduces a critical consideration that every RV owner, especially full-timers, must confront: at what point does the cost of maintenance and repair outweigh the value and benefit of the vehicle? The answer to this question often marks the end of an RV’s journey, and it’s a moment that is coming sooner for the millions of units sold during the pandemic boom.

RVs depreciate at a surprisingly fast rate. On average, a new motorhome loses approximately 20% of its value in the first year alone. After just five years, this depreciation can exceed 60%, and by the ten-year mark, a well-used RV may be worth less than a quarter of its original purchase price.

- The repair cost tipping point: As an RV ages, major mechanical and structural issues become more common. For a vehicle with an already steep depreciation curve, a single extensive repair can wipe out its entire remaining value. A new engine or transmission can cost anywhere from $5,000 to over $20,000, while major repairs for water damage or a failing roof can be just as costly.

- A growing inventory of “junk” RVs: The record-breaking number of RVs purchased between 2020 and 2022 means a corresponding wave of aging vehicles will soon be entering the “end-of-life” phase. This creates a massive and growing market of unwanted units that are either too expensive to repair, too time-consuming to sell privately, or simply too old to drive as you once did.

- The 10-year RV rule at campgrounds: An often-overlooked challenge for owners of older RVs is a policy enforced by a growing number of private campgrounds and resorts. These rules may restrict or even prohibit vehicles older than ten years from staying on their premises, regardless of condition. This can severely limit travel options and make selling an older RV a challenging proposition for private owners.

- Title trouble: A vehicle’s title is crucial, but titles for older RVs can be challenging to locate, as they often become damaged or lost. Without seamless RV selling paperwork, a private sale is nearly impossible, leaving owners with a vehicle that is difficult to dispose of legally and has little to no value.

- A new financial strategy: For an owner facing a four-figure repair bill on a vehicle that may only be worth a fraction of that cost, the economic logic is clear. The most practical path forward is to monetize the vehicle’s remaining value, a decision that unlocks household liquidity and allows the owner to transition to a newer model or adopt a different lifestyle, ultimately completing the full lifecycle of the RV journey.

This reality, while often overlooked in the initial excitement of RV ownership, is a crucial part of the lifestyle. It’s a challenge that requires a reliable and straightforward solution to ensure the journey from open-road adventure to responsible disposal is as seamless and stress-free as possible.

How HeyRV Can Help When It’s Time to Let Go of Your RV

While the RV lifestyle offers many benefits, the reality is that most vehicles eventually reach the end of their usable life. Some sit idle for years, others require repairs that exceed their value, and many simply become impractical to maintain. HeyRV offers a transparent and efficient solution to this problem. Rather than allowing these vehicles to deteriorate in storage or dealing with the challenges of a private sale, owners can rely on HeyRV to manage the entire process responsibly, removing the RV, coordinating proper disposal, and ensuring fair compensation.

| Situation | How HeyRV solves it for you |

| Unwanted or outdated RVs are taking up space | Many owners find themselves with older RVs that no longer serve a purpose but continue to occupy valuable space. HeyRV streamlines removal with complimentary towing and efficient scheduling, allowing owners to reclaim storage areas or driveways quickly. |

| Repairs are too expensive to justify | When major issues such as engine failure, roof leaks, or structural rust make repair costs exceed the vehicle’s value, HeyRV provides a practical exit. Instead of investing further in a depreciating asset, owners can transition out of the situation while receiving fair compensation. |

| Inherited or abandoned RVs | It is not uncommon for individuals to inherit an RV unexpectedly or discover one left on a property. In these cases, HeyRV handles removal legally and professionally, managing all logistics, including transportation, so that owners are not burdened with unwanted assets. |

| Relocation or downsizing | During moves or property transitions, coordinating the disposal of an RV can add complexity to an already demanding process. HeyRV offers nationwide pickup, ensuring that owners can relocate or downsize without delays caused by an unused vehicle. |

| Challenges of private sales | Selling an older or damaged RV privately can be time-consuming and unreliable. HeyRV eliminates these uncertainties by providing a guaranteed offer, confirmed pickup, and complimentary towing, removing the need for listings, negotiations, or buyer follow-through. We also buy junk RVs with salvage titles. |

| Environmental considerations | Disposal is an essential concern for many owners. HeyRV ensures RVs are broken down responsibly, minimizing landfill waste and maximizing material recovery, protecting both your property and the environment. |

HeyRV demonstrates how a focused, nationwide service can simplify RV disposal while addressing both owner concerns and environmental responsibility. By combining efficiency with compliance, the company offers a reliable solution for addressing a common yet often overlooked challenge in vehicle ownership, making it easier than ever to sell your junk RV.

Is This the New American Dream?

The RV lifestyle has proven itself to be more than a passing trend. What began as an improvised solution to a global crisis has grown into a lasting cultural shift, one that blends mobility, affordability, and personal freedom in ways that traditional housing can’t always match.

From millennials building careers on the move to families turning the country into a classroom to retirees trading yards for horizons, RV living is reshaping the definition of “home” for a growing and diverse community. The road has become not just a means of travel, but a place to live.

As the industry evolves with more innovative technology, greener solutions, and more nomad-friendly infrastructure, the opportunities and challenges will continue to expand. For individuals ready to join the movement or those seeking a way to transition out of it, HeyRV stands prepared to help, offering a stress-free and straightforward way to let go of an RV you no longer need.

Because in the end, the American Dream is no longer about the address you keep; it’s about the freedom to choose where the road takes you next.